How Factoring Helps Precision Metal Fabricators

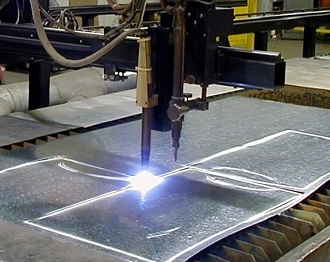

Precision metal fabricators would always be in need of constant cash. Maintaining such a business requires a rather high maintenance cost on top of the initial cash outlay because of many factors. In terms of start-up capital, a lot of funds would be poured into the acquisition of the necessary equipment to begin production. In addition, hiring enough employees to ensure smooth operation means investment in human capital as well. The financial problems do not end here, though, as the cost of maintaining both equipment and employees has proven to be a real financial challenge. As such, if you are planning to be successful in this kind of business, access to easy capital or cash inflow would be highly necessary. If your company has long established a good reputation, then you could easily go for a bank loan. Otherwise, you need alternatives such as invoice factoring.

Precision metal fabricators would always be in need of constant cash. Maintaining such a business requires a rather high maintenance cost on top of the initial cash outlay because of many factors. In terms of start-up capital, a lot of funds would be poured into the acquisition of the necessary equipment to begin production. In addition, hiring enough employees to ensure smooth operation means investment in human capital as well. The financial problems do not end here, though, as the cost of maintaining both equipment and employees has proven to be a real financial challenge. As such, if you are planning to be successful in this kind of business, access to easy capital or cash inflow would be highly necessary. If your company has long established a good reputation, then you could easily go for a bank loan. Otherwise, you need alternatives such as invoice factoring.

How Invoice Factoring Can Help

Invoice factoring involves giving you money, but as opposed to the traditional bank loan, this money is not actually lent to you, but rather given as an advanced payment. Advanced payment for what? Most companies would rely on invoices as form of payment for their services. While some of your clients would be able to convert those invoices into cash in a short time, most of them would not, given how industry standards dictate that waiting for a month or two would just be fine. What happens, then if you suddenly need cash for payroll purposes? Or perhaps an essential equipment in your factory breaks down and is in need of quick repair in order not to disrupt your business? This is where invoice factoring enters the scene.

Like a Loan but Not Quite

Precision metal fabricators are among the many industries serviced by factoring agencies. Most of the time, key players in this industry would be needing an extra boost in terms of cash inflow due to unavoidable expenses such as payroll concerns and maintenance equipment. With invoice factoring, one would no longer have to deal with either interest rates or the burden of waiting for invoices to turn into cash. That burden would be carried for you by the factoring agency, with a minimal commission which usually do not exceed 10% of the face value of the invoice. Think of it as paying a premium on convenience; cash when you need it.

How NeeBo Capital Could Help

NeeBo Capital provides invoice factoring services with rates starting at just around 0.59% to 1.5% for flexible terms of 30 days or more. The amounts that could be availed of in flexible terms range from USD5k to USD10 million. Precision metal fabricators are not at all uncommon to NeeBo Capital, as the company is well aware of the large demands of capital involved in running such a business. As such, you could rest assured that your needs would be met with the satisfactory customer service and added perks that your business truly deserves.

Why Choose Us?

Rates at 0.59% - 1.5% for 30 days

Quick Link to Financial Resources:

| Purchase Order Financing | Accounts Receivable Financing | Asset Based Lending Options |

General Articles about Accounts Receivable Financing and Factoring:

» 08/01/2012 Debt Financing or Off Balance Sheet Financing?

» 11/30/2012 Utilizing Factoring as a Alternative to Traditional bank Credit

» 07/22/2012 Increase Your Business Lines Of Credit By Factoring Accounts Receivables

» 09/15/2011 What to know when selecting a Factoring Company